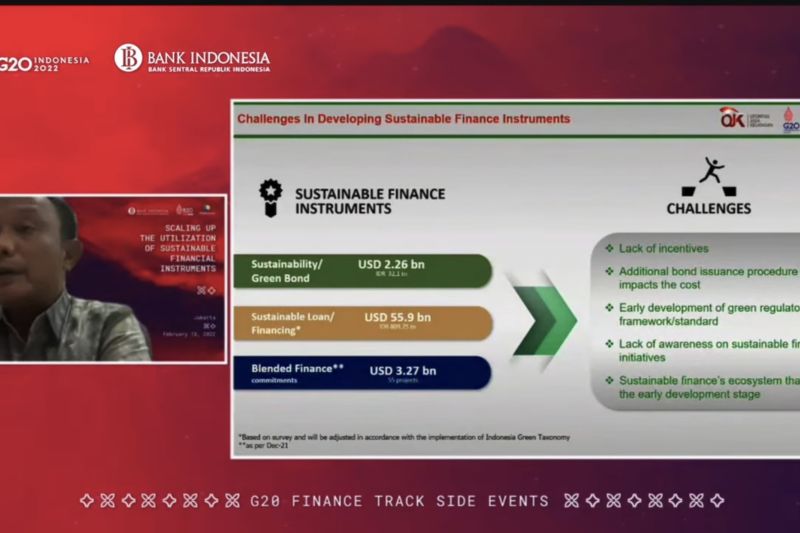

The Financial Services Authority's (OJK's) System Stability Deputy Commissioner Agus Edy Siregar during the Indonesia G20 Presidency agenda titled "Green and Sustainable Instruments as Alternative Financing and Investment & Indonesia’s SF Future Direction" on Friday (February 18, 2022). (ANTARA/AstridFaidlatulHabibah/FR)

The Financial Services Authority (OJK) supports the development of green and sustainable finance instruments in Indonesia, with improvements being observed, OJK's System Stability Deputy Commissioner Agus Edy Siregar stated.

"This development (of green and sustainable finance instruments) has started to improve and to this day, within the G20, the topic of green economy has become a key matter to be discussed globally," he noted.

During the Indonesia G20 Presidency Agenda event on Friday, Siregar highlighted several sustainable finance instruments that were unveiled.

These include green bond worth Rp32.1 trillion, sustainable financing or loan worth US$55.9 billion, and blended finance that reached US$3.27 billion spread across 55 projects.

"It should be noted that this data came before we adjust the Green Taxonomy that has been recently unveiled," he elaborated.

According to Siregar, several challenges exist in issuing a green instrument, such as the lack of incentive to issue green bond or finance in the green sector.

This occurs due to the need for additional procedure to verify or determine whether a certain sector is green.

Moreover, the biggest challenge lies in the price similarity between green and non-green bonds in the market as well as the additional cost for verifying and others.

To this end, a good design is deemed necessary, so that the interest to issue green instruments or green financing could increase further in future, he noted.

Moreover, in the past, there was a lack of standardization between green and non-green sectors in order to enable sectors to have a common language to design the financing.

"In the past, sustainable finance or green economy was also in its early development phase," Siregar stated.

Related news: G20 opportunity to expand farmers' access to global markets: CIPS

Related news: Indonesian G20 pushes for concrete actions in three priority fields

Related news: Normalization of calibrated policies should occur in all countries: BI

"This development (of green and sustainable finance instruments) has started to improve and to this day, within the G20, the topic of green economy has become a key matter to be discussed globally," he noted.

During the Indonesia G20 Presidency Agenda event on Friday, Siregar highlighted several sustainable finance instruments that were unveiled.

These include green bond worth Rp32.1 trillion, sustainable financing or loan worth US$55.9 billion, and blended finance that reached US$3.27 billion spread across 55 projects.

"It should be noted that this data came before we adjust the Green Taxonomy that has been recently unveiled," he elaborated.

According to Siregar, several challenges exist in issuing a green instrument, such as the lack of incentive to issue green bond or finance in the green sector.

This occurs due to the need for additional procedure to verify or determine whether a certain sector is green.

Moreover, the biggest challenge lies in the price similarity between green and non-green bonds in the market as well as the additional cost for verifying and others.

To this end, a good design is deemed necessary, so that the interest to issue green instruments or green financing could increase further in future, he noted.

Moreover, in the past, there was a lack of standardization between green and non-green sectors in order to enable sectors to have a common language to design the financing.

"In the past, sustainable finance or green economy was also in its early development phase," Siregar stated.

Related news: G20 opportunity to expand farmers' access to global markets: CIPS

Related news: Indonesian G20 pushes for concrete actions in three priority fields

Related news: Normalization of calibrated policies should occur in all countries: BI